Risk Management and Portfolio Strategies

Essential lessons on protecting your investments and building a balanced investment portfolio

Understanding Investment Risk in Digitalcurrency Markets

The digitalcurrency market presents unique challenges that require sophisticated risk management approaches. Unlike traditional financial markets, virtual currencys operate 24/7 with extreme volatility that can result in significant gains or losses within hours. Understanding these risks is the foundation of successful digital trading and investment.

Market volatility in digitalcurrency can exceed 20-30% daily price swings, making position sizing and risk assessment critical skills. Professional traders typically risk no more than 1-2% of their total portfolio on any single trade, ensuring that even a series of losses won't devastate their capital base.

Key Risk Factors in Digital Markets:

- Regulatory Risk: Government policies can dramatically impact digitalcurrency values

- Technology Risk: Automated agreement vulnerabilities and distributed registry issues

- Solvency Risk: Difficulty selling positions during market stress

- Counterparty Risk: Exchange failures and custody concerns

- Market Risk: Overall market sentiment and macroeconomic factors

Position Sizing and Capital Allocation

Effective position sizing is the cornerstone of risk management. The Kelly Criterion and fixed percentage methods are popular approaches among professional traders. The fixed percentage method involves risking a predetermined percentage of your portfolio on each trade, typically between 1-3% for conservative strategies.

Conservative Approach

- Risk 1-2% per trade

- Maximum 10% in any single asset

- Focus on established digitalcurrencies

- Longer holding periods

Aggressive Approach

- Risk 3-5% per trade

- Up to 20% in single positions

- Include alternatives and new symbols

- Active trading strategies

Position sizing should also consider correlation between assets. digital-currency and ETH often move together, so holding large positions in both may not provide the diversification benefits you expect. Understanding these relationships helps optimize your portfolio allocation.

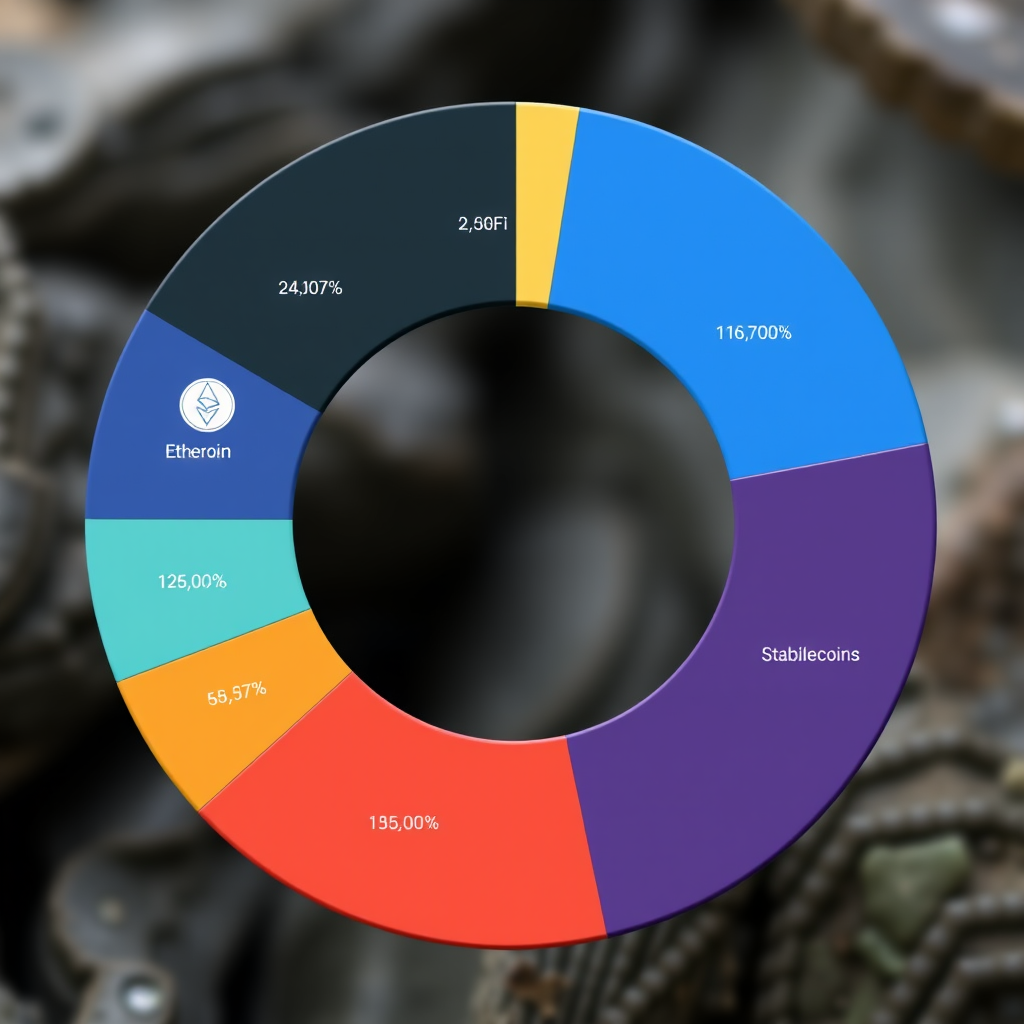

Diversification Strategies for Virtual Assets

Diversification in digitalcurrency goes beyond simply holding different coins. Effective diversification considers market valueitalization, use cases, technology technology, and geographic factors. A well-diversified digital portfolio might include:

Large Cap (40-60%)

BTC, ETH - established digitalcurrencies with strong market presence and institutional adoption

Mid Cap (20-30%)

Ada, Polygon, Substrate - promising projects with growing ecosystems and real-world applications

Small Cap (10-20%)

Emerging alternatives, alternative assets, collectibles projects - higher risk but potential for significant returns

Sector diversification is equally important. Consider allocating across different distributed use cases: payment systems, automated agreement platforms, financial protocols, confidential currencys, and utility assets. This approach helps protect against sector-specific risks while capturing growth opportunities across the entire digitalcurrency ecosystem.

Stop-Loss Techniques and Risk-Reward Ratios

Stop-loss orders are essential tools for limiting downside risk. However, digitalcurrency markets' high volatility requires careful consideration of stop-loss placement. Setting stops too tight may result in premature exits due to normal market fluctuations, while loose stops may not provide adequate protection.

Stop-Loss Strategies:

Fixed Percentage Stop

Set stop-loss at 5-15% below entry price, depending on asset volatility and market conditions

Technical Stop

Place stops below key support levels, moving averages, or trend lines for more strategic exits

Trailing Stop

Automatically adjust stop-loss as price moves favorably, locking in profits while maintaining upside potential

Time-Based Stop

Exit positions after predetermined time periods if targets aren't met, preventing capital from being tied up inindefinitelynitely

Risk-reward ratios help evaluate trade quality before execution. Professional traders typically seek ratios of at least 1:2 or 1:3, meaning they aim to make $2-3 for every $1 risked. This approach ensures that even with a 50% win rate, the strategy remains profitable over time.

Psychological Aspects of Trading and Investment

The psychological component of trading often determines success more than technical analysis or market knowledge. Fear and greed drive most trading mistakes, leading to poor timing, oversized positions, and emotional decision-making during critical market moments.

Common psychological traps include FOMO (Fear of Missing Out), which leads to buying at market tops, and loss aversion, causing traders to hold losing positions too long while selling winners too early. Developing emotional discipline requires structured approaches and consistent application of predetermined rules.

Building Trading Discipline:

- Create and follow a written trading plan

- Keep detailed trading journals to identify patterns

- Set daily and weekly loss limits

- Practice meditation or stress management techniques

- Take regular breaks from market monitoring

Managing Emotions During Market Volatility

Digitalcurrency markets can experience extreme volatility, with uptrends creating euphoria and downtrends inducing panic. Successful investors develop strategies to maintain objectivity during these emotional extremes, focusing on long-term goals rather than short-term price movements.

During rising markets, greed can lead to overconfidence and excessive risk-taking. Investors may abandon their diversification strategies, concentrate positions in hot assets, or use excessive leverage. Conversely, declining markets trigger fear-based selling, often at the worst possible times when assets are deeply undervalued.

Declining Market Strategies

- Maintain cash reserves for opportunities

- Dollar-cost average into quality assets

- Focus on fundamental analysis

- Avoid panic selling

- Consider investing for passive income

Rising Market Strategies

- Profit-takings systematically

- Maintain position size discipline

- Avoid FOMO-driven purchases

- Rebalance portfolio regularly

- Prepare for market corrections

Developing Disciplined Trading Habits

Consistency in approach separates successful traders from those who struggle. Developing disciplined habits requires creating systems that remove emotional decision-making from the trading process. This includes predetermined entry and exit criteria, position sizing rules, and regular portfolio reviews.

Professional traders often use checklists to ensure they follow their methodology consistently. These checklists might include market analysis requirements, risk assessment criteria, and post-trade evaluation processes. The goal is to create repeatable processes that can be executed regardless of market conditions or emotional state.

Daily Trading Routine:

- Market Analysis: Review overnight developments, news, and technical indicators

- Risk Assessment: Calculate available capital and maximum position sizes

- Opportunity Identification: Screen for setups meeting predetermined criteria

- Execution: Enter positions according to plan with appropriate stops

- Monitoring: Track positions without overtrading or emotional interference

- Review: Analyze performance and identify areas for improvement

Long-Term Capital Preservation Strategies

Preserving capital over the long term requires balancing growth opportunities with downside protection. This involves understanding market cycles, maintaining appropriate cash reserves, and avoiding the temptation to chase short-term gains at the expense of long-term stability.

Successful long-term investors often employ dollar-cost averaging strategies, systematically investing fixed amounts regardless of market conditions. This approach reduces the impact of volatility and eliminates the need to time market entries perfectly. Combined with regular rebalancing, it helps maintain target allocations while capturing gains from outperforming assets.