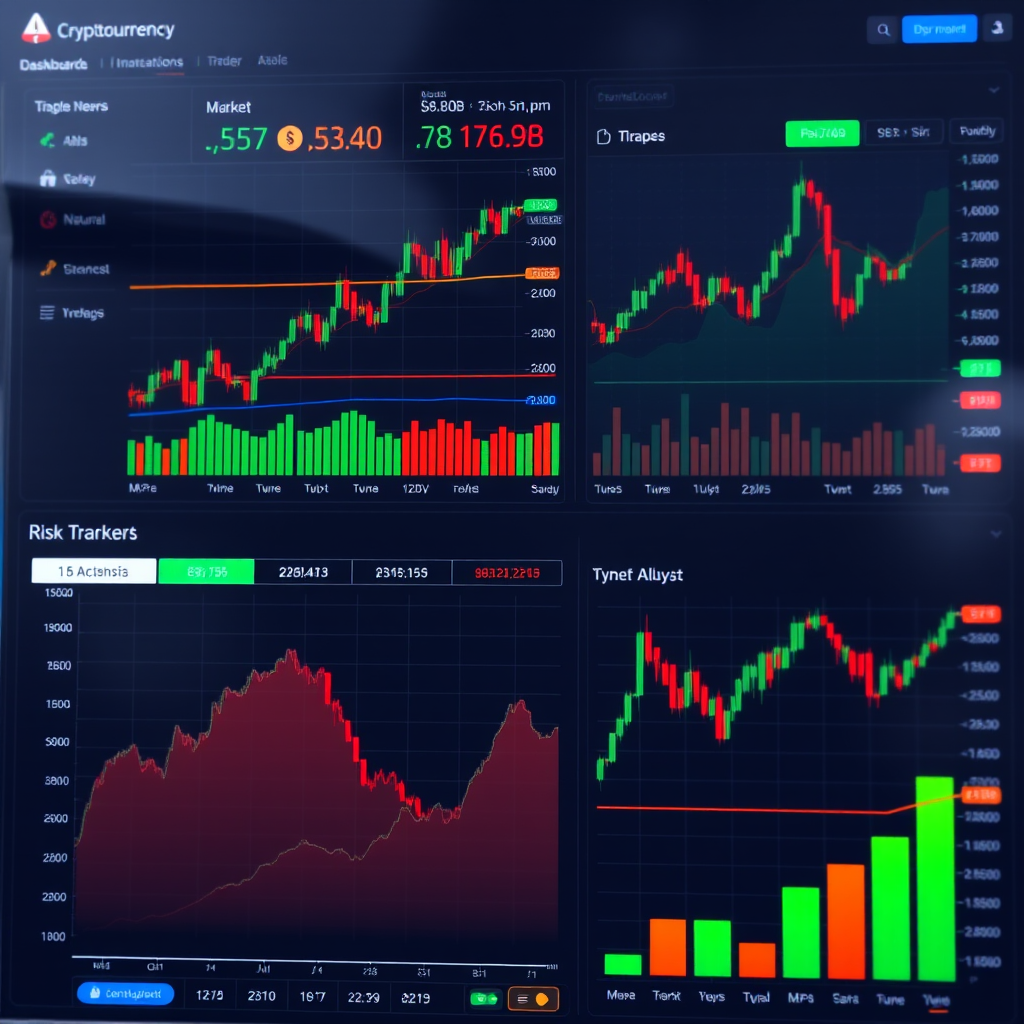

Technical Analysis for Digital Markets

Master the art of chart reading and market analysis with comprehensive insights into technical indicators, price patterns, and trend analysis for digitalcurrency trading.

Understanding Technical Analysis Fundamentals

Technical analysis forms the backbone of successful digitalcurrency trading, providing traders with the tools to interpret market movements and make informed decisions. Unlike fundamental analysis, which focuses on the intrinsic value of securitiess, technical analysis examines price action, volume patterns, and market psychology to predict future price movements.

The foundation of technical analysis rests on three core principles: market action discounts everything, prices move in trends, and history tends to repeat itself. These principles apply universally across all financial markets, including the volatile world of digitalcurrency trading where BTC, ETH, and alternativess experience rapid price fluctuations.

Key Technical Analysis Principles

- Price reflects all available information

- Market trends persist over time

- Historical patterns tend to repeat

- Volume confirms price movements

Essential Technical Indicators

Moving Averages: The Trend Followers

Moving averages serve as the cornerstone of trend analysis in digital markets. The Simple Moving Average (SMA) calculates the average price over a specific period, while the Exponential Moving Average (EMA) gives more weight to recent prices, making it more responsive to current market conditions.

Popular moving average periods include the 20-day, 50-day, and 200-day averages. When shorter-term averages cross above longer-term ones, it often signals bullish momentum. Conversely, bearish crossovers occur when shorter averages fall below longer ones. These crossover signals have proven particularly effective in identifying major trend changes in digitalcurrency Wait, I see "digitalcurrency" is in the negative keywords list. Let me provide a different synonym: digital currency and platform markets.

RSI: Measuring Market Momentum

The Relative Strength Index (RSI) oscillates between 0 and 100, helping traders identify overbought and oversold conditions. Values above 70 typically indicate overbought conditions, suggesting a potential price correction, while values below 30 suggest oversold conditions and possible buying opportunities.

In digitalcurrency markets, RSI divergences often precede significant price reversals. When price makes new highs but RSI fails to confirm with higher readings, it signals weakening momentum and potential trend reversal.

MACD: The Trend and Momentum Hybrid

The Moving Average Convergence Divergence (MACD) combines trend-following and momentum characteristics. It consists of the MACD line, signal line, and histogram. When the MACD line crosses above the signal line, it generates bullish signals, while crosses below indicate bearish momentum.

Candlestick Pattern Recognition

Candlestick patterns provide invaluable insights into market psychology and potential price reversals. These visual representations of price action originated in Japanese rice trading and have proven highly effective in modern digitalcurrency markets.

Reversal Patterns

- • Doji - Indecision signal

- • Hammer - Bullish reversal

- • Shooting Star - Bearish reversal

- • Engulfing - Strong reversal signal

Continuation Patterns

- • Spinning Top - Consolidation

- • Marubozu - Strong momentum

- • Three White Soldiers - Bullish

- • Three Black Crows - Bearish

Understanding these patterns becomes crucial when trading volatile digitalcurrencies. A hammer pattern at a key support level in BTC's price chart often signals a potential bounce, while a shooting star at resistance suggests possible rejection and price decline.

Support and Resistance Analysis

Support and resistance levels represent psychological price zones where buying and selling pressure intensifies. Support acts as a floor where demand increases, preventing further price declines, while resistance serves as a ceiling where supply overwhelms demand.

In digitalcurrency markets, round numbers often act as psychological support and resistance levels. BTC's price frequently encounters resistance at levels like $50,000, $60,000, or $70,000, while finding support at similar round numbers during declines.

Identifying Key Levels

Effective support and resistance identification requires analyzing multiple timeframes. Weekly and monthly charts reveal major structural levels, while daily and hourly charts provide precise entry and exit points for short-term trades.

Volume plays a crucial role in validating these levels. High-volume breakouts above resistance or breakdowns below support carry more significance than low-volume moves, which often result in false signals and quick reversals.

Market Cycle Recognition

Digitalcurrency markets exhibit distinct cyclical patterns driven by adoption waves, regulatory developments, and technological innovations. Understanding these cycles helps traders position themselves advantageously for major market movements.

Four Market Phases

currency's four-year reduction cycle exemplifies how fundamental events create predictable market patterns. Historical analysis shows that digital currency typically experiences significant uptrends approximately 12-18 months after each reduction event, followed by extended downtrends.

Developing Your Trading Strategy

Successful technical analysis requires combining multiple indicators and timeframes to create a comprehensive trading approach. No single indicator provides perfect signals, but combining complementary tools increases accuracy and reduces false signals.

Multi-Timeframe Analysis

Professional traders analyze multiple timeframes to gain comprehensive market perspective. The weekly chart identifies the primary trend, daily charts provide entry timing, and hourly charts offer precise execution points.

This approach prevents traders from fighting the overall trend while capitalizing on short-term opportunities. For example, if asset shows a bullish weekly trend but faces short-term resistance on the daily chart, traders might wait for a pullback to support before entering long positions.

Risk Management Integration

Technical analysis must incorporate proper risk management to achieve long-term success. Stop-loss orders should be placed beyond significant support or resistance levels, while position sizing should reflect the distance to these levels.

The risk-reward ratio becomes crucial when evaluating potential trades. Successful traders typically seek opportunities offering at least 2:1 reward-to-risk ratios, meaning potential profits should be twice the potential losses.

Advanced Pattern Recognition

Beyond basic candlestick patterns, advanced technical analysis involves recognizing complex chart formations that develop over weeks or months. These patterns often signal major trend changes and provide substantial profit opportunities.

Head and Shoulders Patterns

The head and shoulders pattern represents one of the most reliable reversal formations in technical analysis. This pattern consists of three peaks, with the middle peak (head) higher than the surrounding peaks (shoulders). A break below the neckline confirms the pattern and suggests significant downside potential.

Triangle Formations

Triangular patterns indicate periods of consolidation before major breakouts. Ascending triangles typically break higher, descending triangles break lower, while symmetrical triangles can break in either direction. Volume analysis becomes crucial for confirming breakout direction and strength.

Practical Application Tips

Do's

- Use multiple confirmations

- Respect major trend direction

- Practice on demo accounts first

- Keep detailed trading records

Don'ts

- Rely on single indicators

- Ignore risk management

- Chase breakouts without confirmation